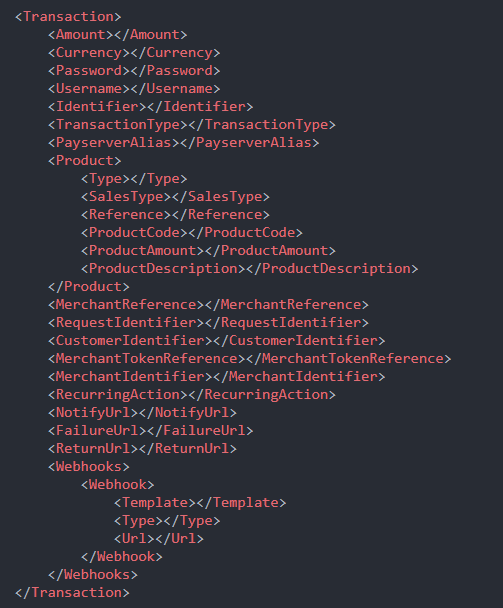

Merchants must create a Transaction object that will be encrypted and sent to the Payment Gateway as an HTML form POST.

Take note, this is a lengthy batch process and runs as scheduled tasks between VFS and the bank.

It should never be relied upon to be returned quickly or included in a synchronous user-journey with the customer.

| # | Field (Case-Sensitive) |

Required MandatoryOptional |

Type | Length | Description |

|---|---|---|---|---|---|

| 1. | Transaction ф | M | N/A | N/A | The tokenization request transaction object |

| 2. | Amount | M | decimal | unrestricted | Transaction amount |

| 3. | Currency ф | M | string | 3 | The ISO currency code, e.g. ZAR |

| 4. | Password ф | M | String | <= 350 | Merchant password (maximum length 350) as defined by the Payserver service account |

| 5. | Username ф | M | String | <= 50 | Merchant username (maximum length 50) as defined by the Payserver service account |

| 6. | Identifier | M | String | unrestricted | Unique identifier issued by the merchant representing the instance of the request. Preferably a GUID. |

| 7. | TransactionType | M | String | 2 | Transaction type can be either “01” (Auth & Settle), or “02” (Auth) |

| 8. | PayserverAlias ф | M | String | 255 | The Payserver alias name defined for the merchant by VPG |

| 9. | Product | O | N/A | N/A | An array of one or more products that is being purchased |

| 10. | Type | O | String | Recharge type. Airtime or ppd (maximum length 50) [Deprecated] | |

| 11. | SalesType ф | O | String | 2 | Sales type can be either 00, 01 or 03. [Deprecated] |

| 12. | Reference | O | String | <= 50 | Recharge MSISDN (maximum length of 50). [Deprecated] |

| 13. | ProductCode | O | String | <= 50 | Product code defined by the merchant (maximum length of 50) |

| 14. | ProductAmount | O | Decimal | unrestricted | Product amount defined by the merchant |

| 15. | ProductDescription | O | String | <= 500 | Product description defined by the merchant. |

| 16. | MerchantReference | M | String | <= 50 | Reference the merchant includes in the form post to identify the transaction on his system.. |

| 17. | RequestIdentifier | M | String | <= 50 | Included by the merchant in the form post to uniquely identify the transaction on their system. |

| 18. | CustomerIdentifier | M | String | <= 250 | Included by the merchant in the form post to uniquely identify the customer on their system.. |

| 19. | MerchantTokenReference | O | String | <= 250 |

A unique identifier provided by the merchant for instances where they wish to cater for multiple customer subscriptions. A combination of customeridentifier and merchanttokenreference will create a unique token, and allow a single customer to be able to have multiple subscriptions. If this field is not passed it will be set to CustomerIdentifier above. |

| 20. | MerchantIdentifier ф | M | String | 36 | Unique identifier issued to the merchant by VFS to identify him on VPG. Adheres to pattern. |

| 21. | RecurringAction ф | M | String | 1 | This determines whether the tokenisation request is a:

1 – Subscribe 2 – Update An update will override the current token or add a new one, while the subscribe will only add a new profile and fail if one already exists. |

| 22. | NotifyUrl ф | M | String | <= 500 |

This is the end–point to which the asynchronous tokenisation response, will be posted back to the merchant–s server, once the bank has responded with the token creation (success or failure). This is an asynchronous post-back to the merchant. See 3.1.9.2 Tokenisation Response Field Definitions for further detail. |

| 23. | FailureUrl ф | M | String | <= 500 |

This is the redirect end–point to which payment gateway will respond synchronously, after the payment has been completed unsuccesfully (either Auth or Auth & Settle). See 3.1.7.1 HTTPS Form Post-Back for further detail. |

| 24. | ReturnUrl ф | M | String | <= 500 |

This is the redirect end–point to which payment gateway will respond synchronously, after the payment has been completed successfully (either Auth or Auth & Settle). See 3.1.7.1 HTTPS Form Post–Back for further detail. |

| 25. | WebHooks | O | N/A | N/A |

One or more webhooks to provide asynchronous notifications for the outcome of the credit–card payment back to the merchant. See 3.1.8 Tokenisation: Step 6 – Asynchronous WebHooks response from VPG for the Payment for further detail. |

| 26. | WebHook ф | O | N/A | N/A | The WebHook definition defining the custom template, post–back method and end-point to respond to. |

| 27. | Template | M | String | <= 500 | A Base64 encoded string of the webhooks template parameters passed by the merchant, to be used for the asynchronous transaction result post–back. |

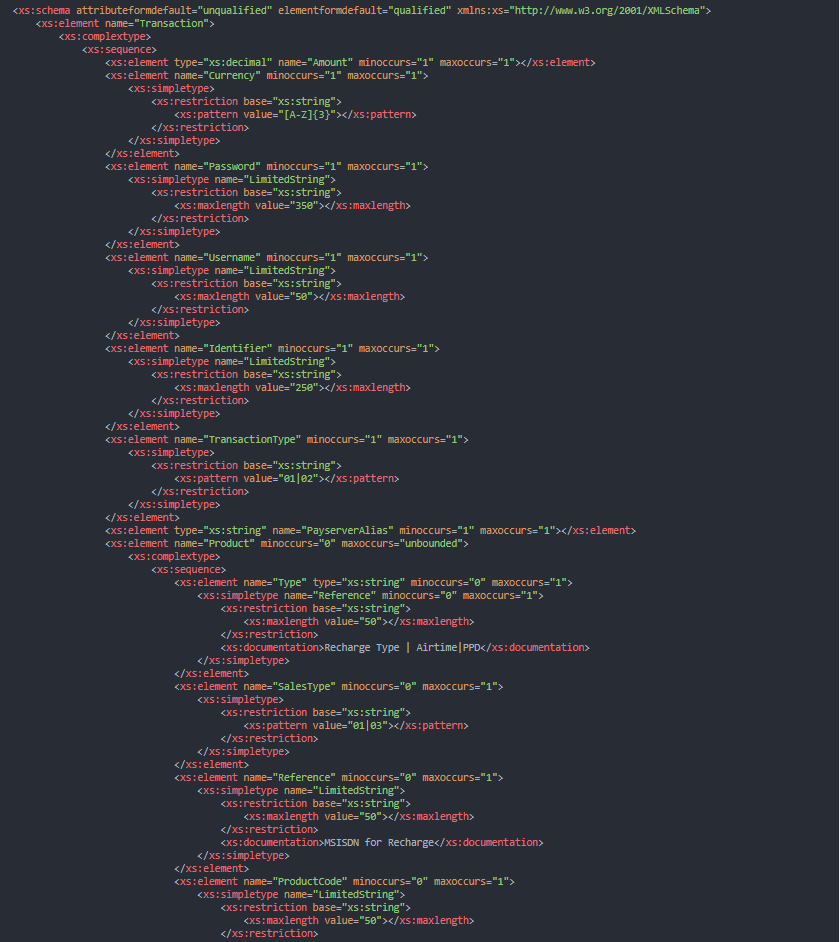

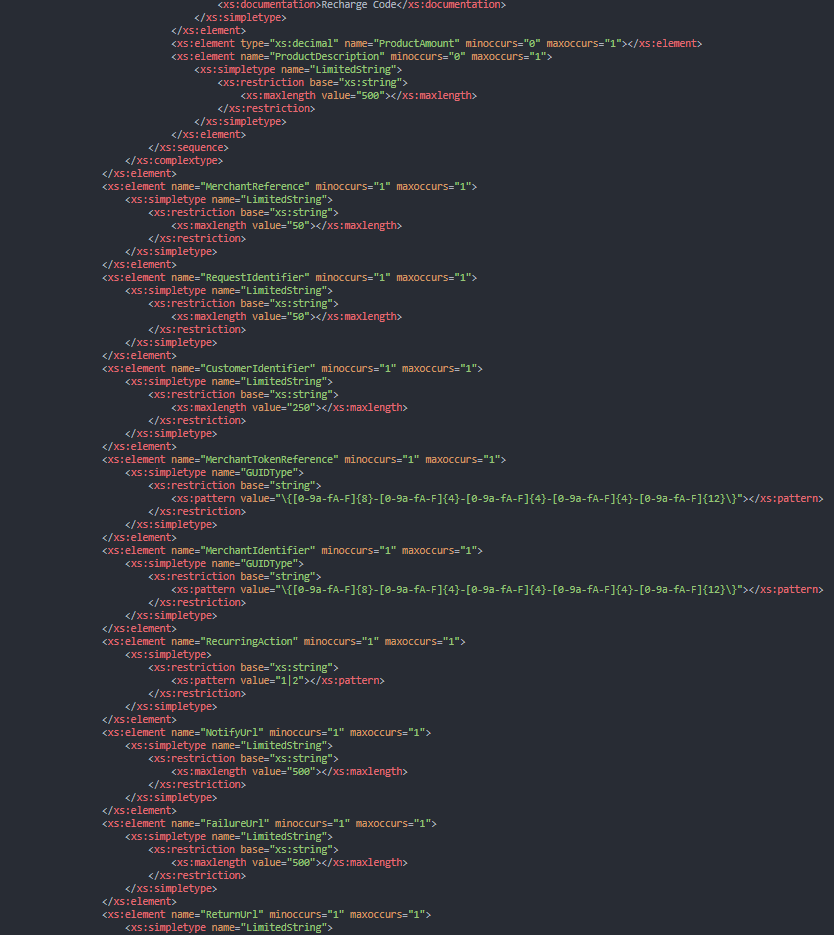

For confirmation of the transaction object field data types, length, and whether they are mandatory or not, the following XML schema can be queried.

You can also search this schema online at: https://qa.vodacompaymentgateway.co.za/api/docs/Recurring/